Our discounted payback period calculator calculates the discount cash flow accurately and provides you with the complete cash flow in the form of table. The payback period is a crucial concept in finance and investment analysis. It represents the time required for an investment to recoup its initial cost through the returns generated, allowing investors to weigh up the risk and reward of investment opportunities. This article aims to provide a thorough guide to the Payback Period Calculator, including its history, how to use it, and its applications in business, education, and daily life. We also provide numerous examples of calculations and useful visual aids to enhance understanding.

Payback Period Case Study Example

A higher payback period means it will take longer for a company to cover its initial investment. All else being equal, it’s usually better for a company to have a lower payback period as this typically represents a less risky investment. The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. Many managers and investors thus prefer to use NPV as a tool for making investment decisions. The NPV is the difference between the present value of cash coming in and the current value of cash going out over a period of time.

- By launching the new feature, you expect to make $50,000 in the next six months.

- The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it.

- Knowing the payback period is helpful if there’s a risk of a project ending in the future.

- Its accuracy depends on the precision of the input data, particularly cash flow projections.

How to calculate payback period with irregular cash flows

Suppose that a business makes a $10,000 investment that will generate $2,000 in additional revenue every year into the foreseeable future. This means that the initial investment will be $10,000 and that the annual cash flow would be $2,000. As mentioned above, the payback period is the amount of time it takes to recover the initial graduating from turbotax costs of an investment. So, if a business invested $5,000 in a specific investment, the payback period will represent the exact amount of time before that investment has generated $5,000. It is a rate that is applied to future payments in order to compute the present value or subsequent value of said future payments.

Applying the Payback Period in the Business World

This period is crucial for investors and businesses as it helps in evaluating the feasibility and profitability of investments. The primary use cases of the payback period include assessing the risk and liquidity of projects. Most capital budgeting formulas, such as net present value (NPV), internal rate of return (IRR), and discounted cash flow, consider the TVM. So if you pay an investor tomorrow, it must include an opportunity cost. Another limitation of the payback period is that it doesn’t take the time value of money (TVM) into account. The time value of money is the idea that cash will be worth more in the future than it is worth today, due to the amount of interest that it can generate.

Get up to $1,000 in stock when you fund a new Active Invest account.*

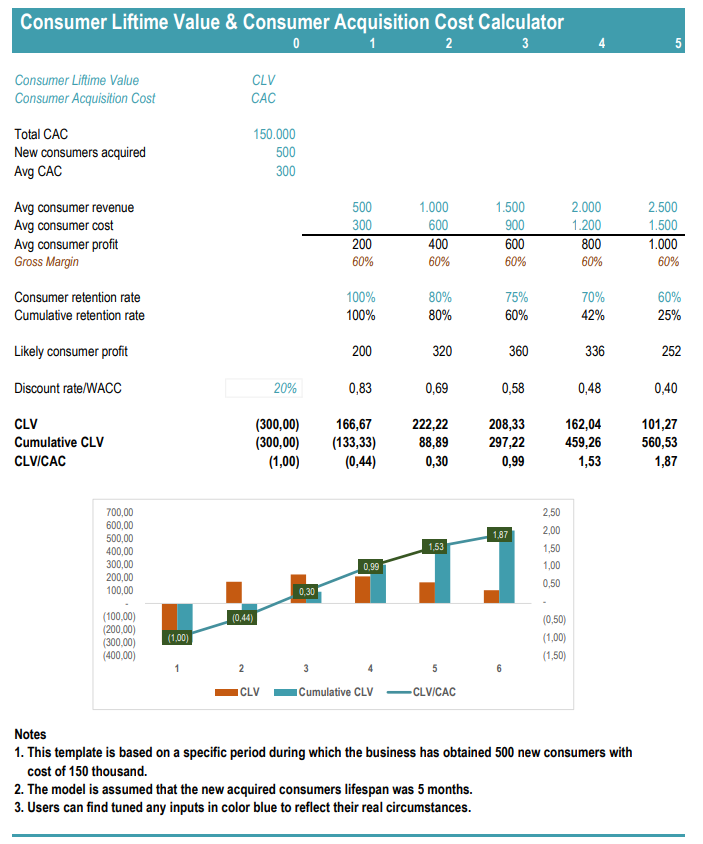

The online discounted payback period calculator performs the calculations based on the initial investment, discount rate, and the number of years. The discounted payback period is often used to better account for some of the shortcomings, such as using the present value of future cash flows. For this reason, the simple payback period may be favorable, while the discounted payback period might indicate an unfavorable investment. The payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year.

Pros and Cons of Using the Payback Period Calculator

This is why alternate methods for measuring project value such as NPV are used. So, the two parts of the calculation (the cash flow and PV factor) are shown above.We can conclude from this that the DCF is the calculation of the PV factor and the actual cash inflow. If you can add the estimated timeframe a feature will take to complete, you can start to prioritize features that may generate more revenue more quickly, allowing for faster growth. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. The reason is that the longer the money is tied up, there are fewer chances to invest it anywhere else.

The formula for calculation of payback period (fixed cash flow) mentioned-earlier in the content. Once the payback period has been completed, the business will enter the profitability period, ceteris paribus, which means that “other things being equal or held constant”. In other words, nothing has changed in terms of the demand for the firm’s product, or the costs of supplying its product. In this article, you will learn how to calculate the payback period, why it’s important, and how you can use it to optimize your feature development.

As seen, a consistent pattern emerges where a higher initial investment and proportional annual cash flow result in a similar payback period. The optimal strategy is ensuring cash flows are sustainable and realistic. The graph above represents an example of a cumulative cash flow over time for an initial investment of $20,000 and an annual return of $5,000. The X-axis represents time in years, and the Y-axis represents the cash flow. People and corporations mainly invest their money to get paid back, which is why the payback period is so important.

His anticipated annual savings from reduced rental costs and increased efficiency is $5,000. Have you ever wondered how long it will take to get your money back on an investment? The Payback Period calculation formula will give you the answer you need.