This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment.

Contribution Margin: What Is It and How To Calculate It

This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. The contribution margin income statement separates the splitting payments to reconcile expenses in xero fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin.

How to Calculate Contribution Margin

- Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer.

- A good example of the change in cost of a new technological innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time.

- Contribution margin analysis is the gain or profit that the company generates from the sale of one unit of goods or services after deducting the variable cost of production from it.

- One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services.

- Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency.

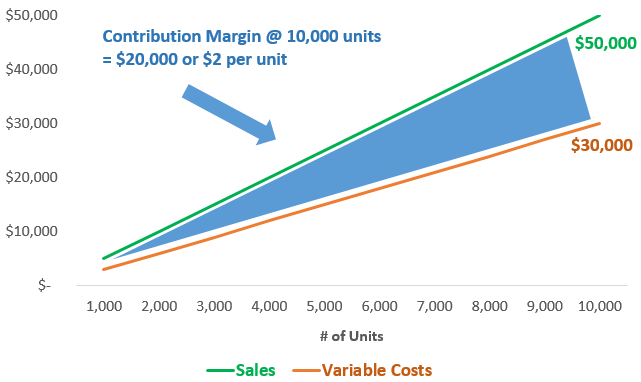

Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio.

To Ensure One Vote Per Person, Please Include the Following Info

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. The formula to calculate the contribution margin is equal to revenue minus variable costs. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible.

And, as a pretty granular number, it gives you insight into a specific product’s profitability, but not the overall company’s profits. For a more holistic view, use it with other profitability ratios such as gross profit, operating profit and net profit. However, this implies that a company has zero variable costs, which is not realistic for most industries. As such, companies should aim to have the highest contribution margin ratio possible, as this gives them a higher likelihood of covering its fixed costs with the money remaining to reach profitability. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit. The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit. Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin.

A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse. Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point. You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products. Imagine that you have a machine that creates new cups, and it costs $20,000. To make a new cup, you have to spend $2 for the raw materials, like ceramics, and electricity to power the machine and labor to make each product. We explain its formula, differences with gross margin, calculator, along with example and analysis.

These cost components should not be considered while making decisions about cost analysis or profitability measures. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal.

It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process. The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs. If the fixed costs have also been paid, the remaining revenue is profit.